Stay Ahead of the Curve

Latest AI news, expert analysis, bold opinions, and key trends — delivered to your inbox.

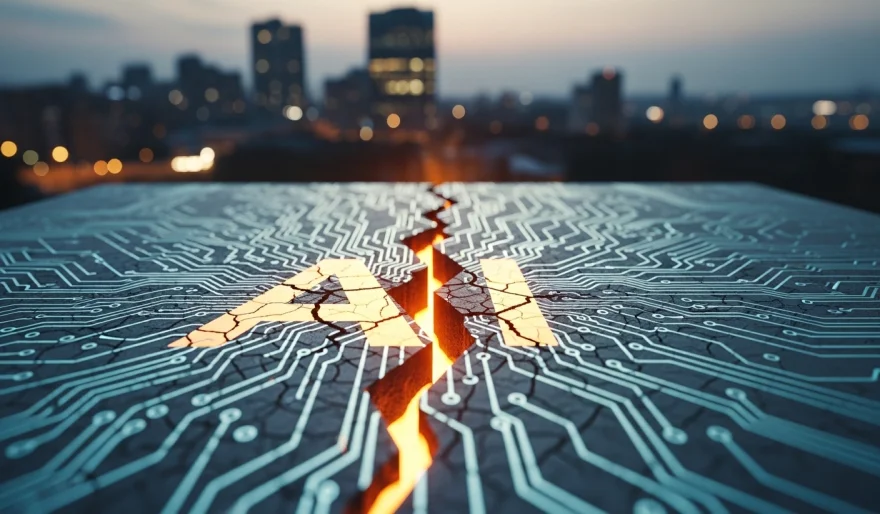

The AI Boom Is Cracking And Investors Are Finally Waking Up

3 min read The AI trade is fracturing. Investors are no longer buying every AI stock — they’re separating real winners from hype. Rising capex, growing debt, and unclear profits are forcing Wall Street to pick sides. The AI boom is entering its “survival of the fittest” phase. February 06, 2026 15:40

For two years, the AI market moved like a single wave.

If a company touched AI, its stock surged. Chips, software, cloud, even random firms with weak AI exposure — everything pumped.

But that era is ending.

The global AI trade is starting to crack.

Investors are no longer treating AI as one big opportunity. Instead, they’re becoming brutally selective — separating companies that truly benefit from AI from those that are simply riding the hype.

Three forces are driving this shift:

1) Exploding AI costs

Building AI is no longer cheap.

Companies are burning billions on data centers, GPUs, energy, and infrastructure — with no guaranteed returns.

2) Rising debt and capital pressure

To keep up in the AI race, firms are taking on massive debt and capex.

Wall Street is now questioning whether the spending spree is sustainable.

3) The profit question

Everyone knows AI is powerful.

But the real question is:

👉 Who actually captures the value?

Chipmakers and cloud giants look like clear winners.

But many software companies and AI-adjacent firms are starting to look vulnerable — especially those whose business models could be disrupted by AI itself.

The market is no longer betting on “AI.”

It’s betting on specific players inside the AI ecosystem.

This is what every tech revolution looks like:

-

Phase 1: Hype — everyone wins.

-

Phase 2: Reality — only the strongest survive.

And right now, the AI industry has officially entered Phase 2.

AI Agents

AI Agents